You just launched a new digital product and your audience is super excited to get their hands on it. They troop to your store’s checkout page only to discover that they cannot pay for the product. After multiple trials, they give up and abandon your website.

Now, you’ve lost potential revenue and your sales momentum. But there’s a bigger problem: you’ve also put your brand equity at risk. The next time you send an email announcing a new digital product, your audience might ignore it because they know they won’t be able to pay for the product anyway.

That’s why you need to choose a reliable payment gateway. It’s not just about choosing a payment processor with the widest reach and fastest transaction time. These are important, yes. But you also need to prioritize security and ensure that it isn’t too expensive that it takes all of your profit.

With that, let’s look at 10 popular payment gateways that you can use for digital product sales, including their pros, cons, and pricing/fees.

Skip ahead:

-

Top payment gateways for selling digital products

How to choose the best payment gateway for your digital product business

TL;DR

Here’s a quick look at all the payment gateways we’ll discuss in this article.

| Best For | Top Features | Pricing/fees | |

| Thinkific Payments | Creator educators |

|

|

| PayPal | Global online merchants |

|

|

| Stripe | Global online merchants |

|

|

| Braintree | E-commerce sellers |

|

|

| Helcim | Digital creators and brick-and-mortar businesses |

|

ACH/EFT payments: 0.5% + $0.25 |

| Amazon Pay | Amazon merchants |

|

|

| Shopify Payments | Sellers and resellers on Shopify |

|

|

| Adyen | E-commerce, mobile and point-of-sale payments |

|

€0.11 fixed processing fee plus a secondary fee based on your payment method. |

| Bankful | Receiving crypto payments |

|

|

| Payoneer | E-commerce sellers and merchants |

|

Custom fees from marketplaces |

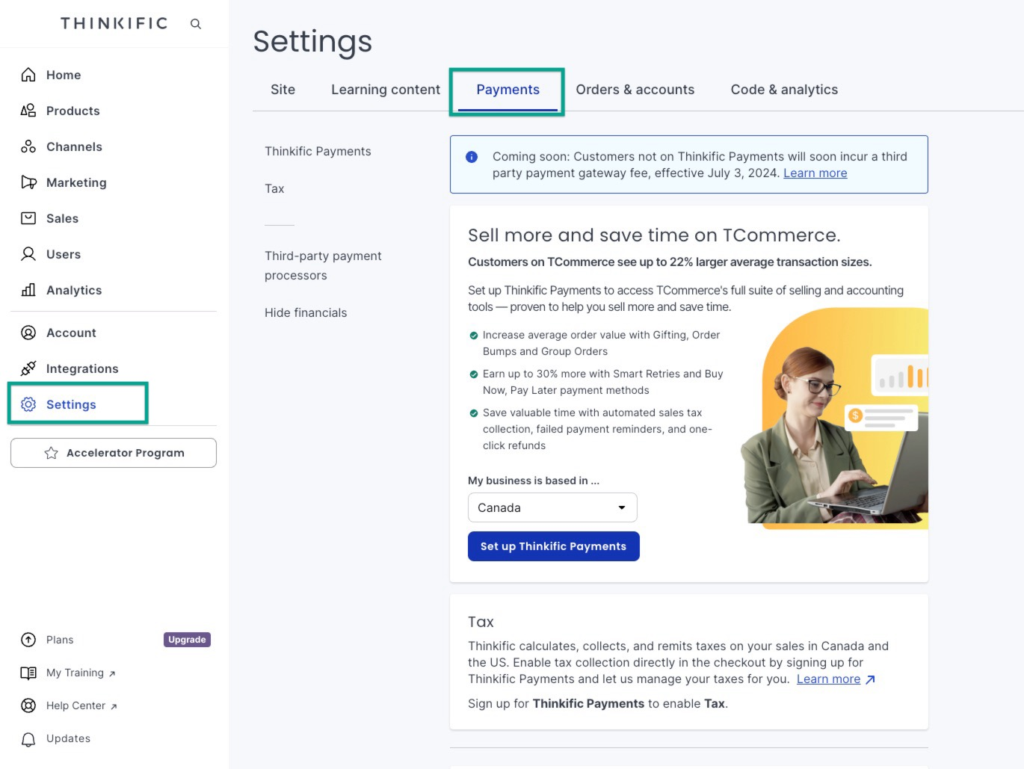

Thinkific Payments: All-in-one payment solution for creator educators

Thinkific Payments is the best payment gateway for digital products. It is a built-in payment processor that lets you accept payments, manage payouts, and process refunds all from your Thinkific dashboard — so you don’t need to switch apps or download anything.

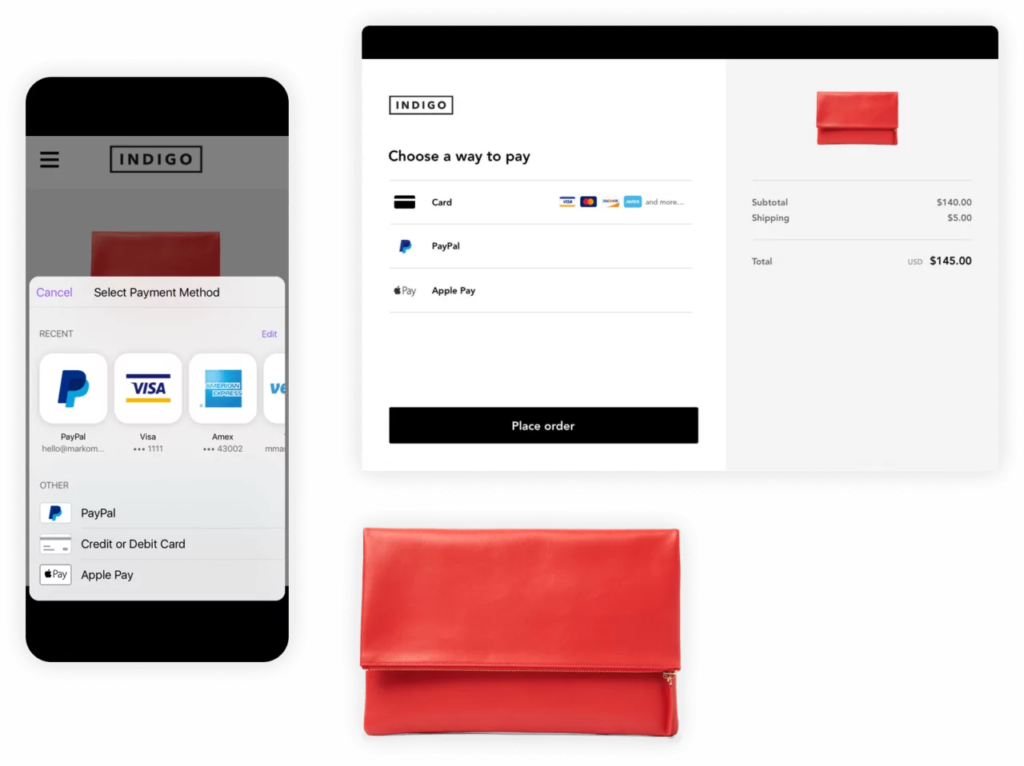

Boost conversions with the Thinkific Payments optimized Performance Checkout and set up a range of payment options for your customers, including Buy Now, Pay Later (BNPL) and digital wallets. Thinkific Payments also offers a wide variety of transaction options so you can easily set up subscriptions, payment plans, and one-time payments.

Pros

- Manage payments directly from the Thinkific dashboard

- Variety of payment options – including subscriptions and one-time payments

- Automatically migrate subscriptions, plans, and billing cycles from Stripe

Cons

- Currently available in USA, Canada, UK and limited release in other countries

- Takes 24-48 hours to verify account details after sign-up

- Changes sent to Site Owner/Site Admins for review

Pricing and Fees

- Free: $0 per month

- Basic: $36 per month

- Start: $74 per month

- Grow: $149 per month

- Expand: $374 per month

- Credit card processing fee: 2.9% + $0.30 per transaction

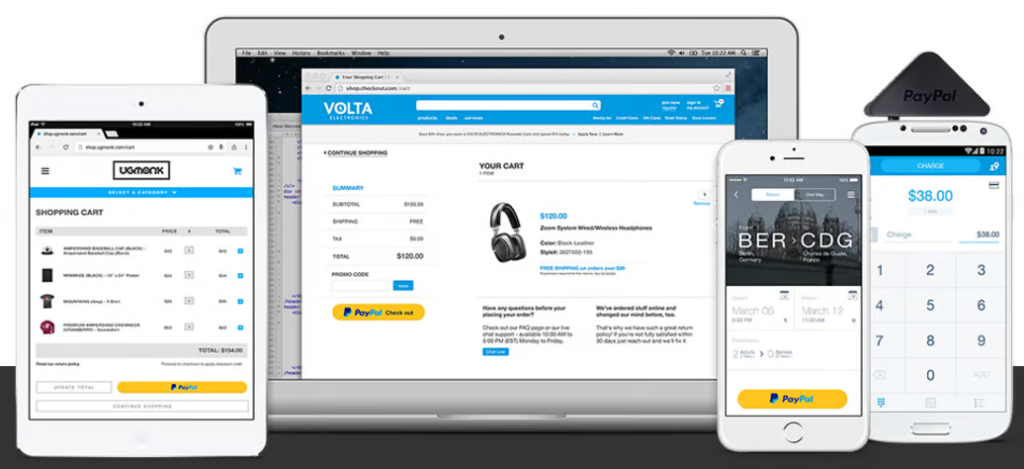

PayPal: Global online payment system

PayPal has over 200 million active users worldwide. It’s secure, scalable, and streamlined, making it ideal for selling digital products.

In fact, 69% of users felt more confident shopping on a website that accepts PayPal. PayPal research also shows a 28% increase in checkout conversions when businesses use PayPal and 19% increase in unplanned purchases when PayPal is an option at checkout.

With multi-channel payment options and powerful conversion tools, PayPal gives you the chance to sell your digital products across a wide range of devices and platforms.

Pros

- Secure payment processing

- Supports 25 currencies

- Good invoicing features

- Easy to integrate into other platforms

- Instant fund access

- Mobile-first payment gateway

Cons

While PayPal has a wide range of benefits, there are also some key drawbacks, including:

- Complex transaction fee structure

- Popular target for phishing and scams

- Poor customer service

Pricing

PayPal doesn’t have monthly subscription fees, but it deducts fees for every transaction depending on the location. Here’s a breakdown of how it works:

- 2.9% + $0.30 per US transaction

- 2.9% + 0.30 CAD per Canadian transaction

- 4.4% and above for international transactions

Here are the full details of PayPal’s merchant fees for online sellers.

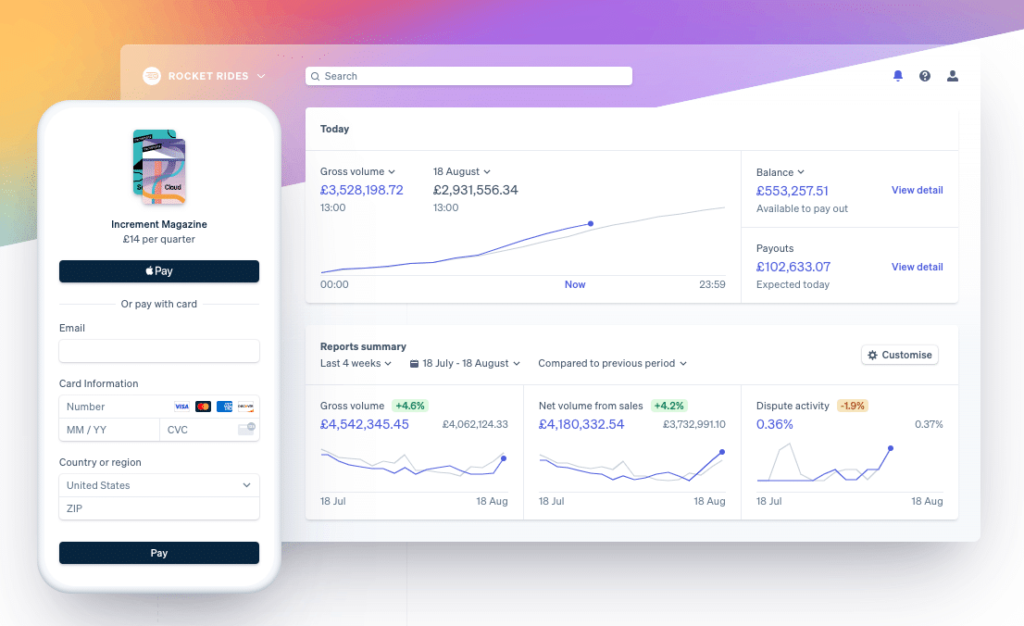

Stripe: Fully integrated payment processing platform

Stripe takes second place as the most used payment gateway globally. With over 1.14 million websites currently using its payment gateway across 47 countries, Stripe has a fast-growing reputation as a top payment gateway for selling digital products.

Pros

Here are some top benefits of Stripe:

- Supports more than 135 currencies

- Flat rate, transparent pricing

- Fully customizable checkout flow

- Advanced technologies to protect customers from fraud

- Deposits payments directly into your account

- Easy to use and set up

Stripe is reasonably priced when compared with other payment processors – you also don’t need to pay anything extra to set up or cancel your account. But there are some drawbacks.

Cons

Here are the downsides to using this payment gateway:

- Difficult to integrate

- Need the help of a developer to customize or add new features

- Limited functionality for in-person transactions

Pricing

Like PayPal and many of the gateways on this list, Stripe doesn’t charge any monthly subscription fees. But it has transaction fees for different payment methods. Here’s a breakdown:

-

2.9% + 30¢ for card transactions

Additional 0.5% per transaction for manually entered cards

Additional 1% fee for transactions requiring currency conversions

0.8% fee for ACH direct debits

Check out Stripe’s full pricing and transaction fees.

Braintree: Streamlined payment platform for e-commerce sellers

Supporting over 130 local currencies in 44 countries, Braintree is a top choice for Creator Educators with a global audience. As an offshoot of PayPal, Braintree has many of the features that users know and love from PayPal, but it’s tailor-made for eCommerce businesses.

The key benefits of using Braintree are the transparent pricing structure and the no-contract obligation, so you can use the product month-to-month as you need it.

Pros

- Transparent, flat-rate pricing

- No long-term signup

- Integrations with PayPal, Venmo, credit and debit cards, and digital wallets like Apple Pay

Cons

- Poor customer support

- Complex interface

- Transaction fees not returned for refunds

Pricing and Fees

- Cards and digital wallets: 2.59% + $0.49 per transaction

- Venmo: 3.49% + $0.49 per transaction

- ACH Direct Debit: 0.75% per transaction

- Additional fees: 1% for transactions in any non-USD currency and 1% for transactions when the customer’s card is issued outside the United States.

Helcim: Payment gateway for digital creators and brick-and-mortar businesses

Designed for businesses with both digital products and brick-and-mortar stores, Helcim is a merchant services provider with an all-inclusive platform for invoicing, payment processing, and online checkouts.

Helcim prides itself on transparency – it aims to be an alternative to other payment gateways known for their hidden fees, rigid contracts, and poor customer service. Helcim lets users close their accounts at any time, and all deposits will be in your bank account within 2 days of the sale.

Pros

- All-in-one platform, including payment gateways, invoicing, and point-of-sale (POS) software

- Transparent pricing structure

- Payment gateway API easy to integrate with third-party software

Cons

- Interchange-plus pricing is harder to predict

- Higher fees than other platforms

- Need at least $25,000 in monthly sales to get the best rates

Pricing and Fees

- Less than $25,000 in monthly card transactions: Interchange plus 0.50% + $0.25 per online transaction

- Fee reduces by 5% as your monthly credit card volume increases

- ACH/EFT payments: 0.5% + $0.25

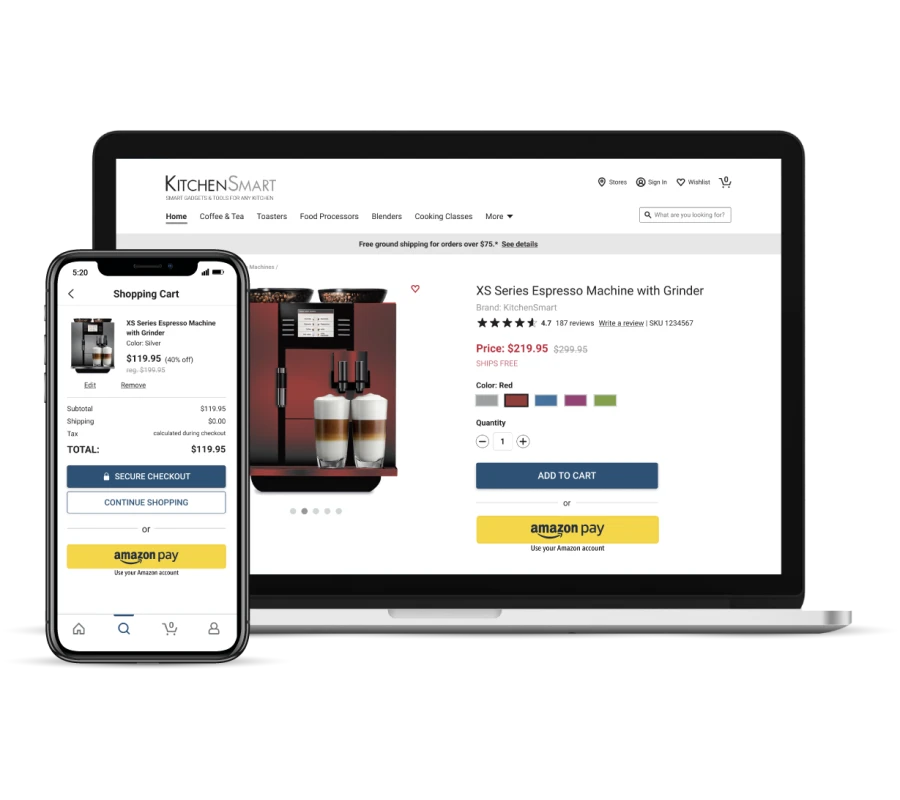

Amazon Pay: In-app payment platform for Amazon merchants

Chances are, most of the people buying your digital products will already have an Amazon account and they’ll have their payment information loaded up and ready to go. Amazon Pay makes your checkout process seamless and extra fast by letting customers use their Amazon account information to make a purchase. Amazon Pay is tailored to online sales and it also supports global customers and a wide range of currencies.

Pros

- Easy for customers with existing Amazon accounts

- Supports multiple currencies

- No setup or monthly subscription fees

Cons

- Need an Amazon Seller account

- Delayed payouts

- Doesn’t offer volume discounts

Pricing and Fees

- Web and mobile: 2.9% + $.30 per transaction

- Alexa: 4% + $.30 per transaction

- Extra 1% for cross-border transactions

Shopify Payments: In-app payment processor for Shopify merchants

Specializing in eCommerce, Shopify is a great option for selling digital products online. Shopify Payments is an integrated payment gateway that lets you start accepting payments immediately, with minimal set-up. This service is included in all of Shopify’s paid subscription plans – and the payment processing rates are competitive.

This platform comes with a wide range of out-of-the-box themes and templates to help you set up a slick and professional digital store in no time. Shopify websites load fast and have lower cart abandonment rates than other platforms, and if you have any problems, Shopify offers 24/7 customer support.

Pros

- Easy to set up and use basic features

- Flexible, customizable checkout

- Customers can pay through any channel – including social media

Cons

- High fees for eCommerce plans

- Fee for using third-party payment gateways

- Difficult to set up integrations for first-time users

Pricing and Fees

- Starter: $5 per month, 5% per online transaction

- Basic: $39 per month, 2.9% + $0.30 USD per online transaction, 2.7% per in-person transaction

- Advanced: $399 per month, 2.4% + $0.30 USD per online transaction, 2.4% per in-person transaction

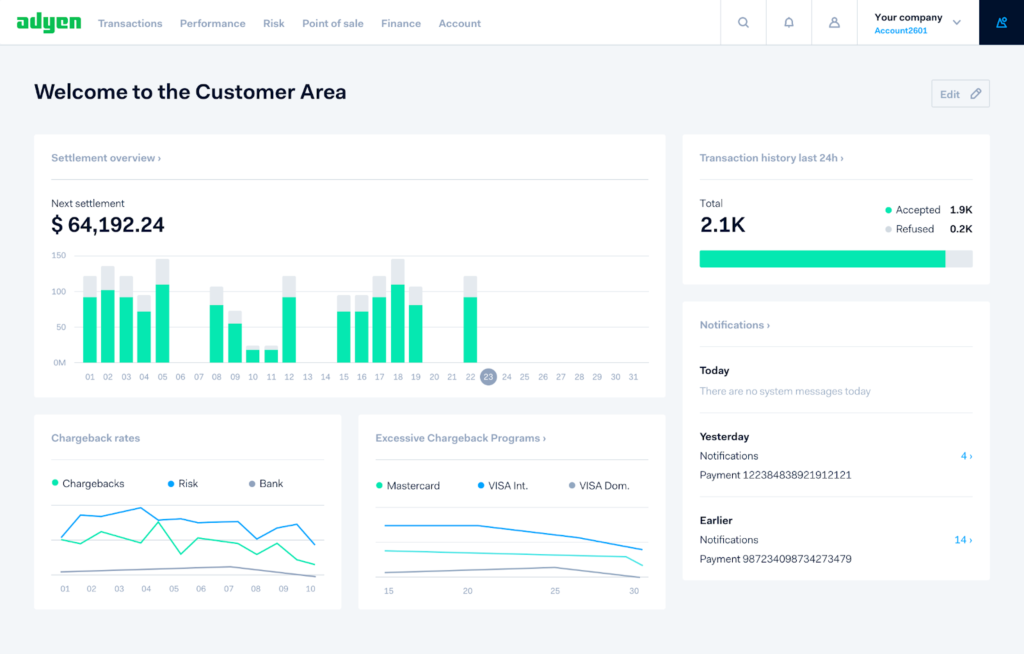

Adyen: One platform for ecommerce, mobile and point-of-sale payments

Adyen is a payment processing platform that provides businesses with a single solution to accept payments globally. Founded in 2006, Adyen has rapidly grown to become a leading payment platform with a presence in over 200 countries and territories.

Adyen offers a wide range of payment methods, fraud detection, and currency conversion services, making it a popular choice for businesses and creators looking to expand their global reach. It has a user-friendly interface and is known for its quick and secure transactions, helping you streamline your payment processes and increase revenue.

Top Features

-

Support for multiple payment methods, including credit cards, bank transfers, and digital wallets

APIs and plugins for integrating Adyen’s payment solution into your website or online store

Support for local payment methods that your students are already familiar with for a smoother payment experience

Fully-customizable payment checkouts

Cons

-

Some users say it’s difficult to contact Adyen’s support team if you run into issues

It can take several weeks to implement Adyen’s payment processor successfully

Adyen has a complex user interface that makes it difficult to use

Pricing

Adyen uses a pay-per-transaction pricing model. It doesn’t charge any setup or monthly maintenance fees. Instead, you pay a €0.11 fixed processing fee plus a secondary fee based on your payment method.

For example, if you receive an ACH payment in the U.S., Adyen will receive €0.11 + €0.27. The full list of fees for supported payment methods is available here.

Bankful: Crypto-enabled payment processor

Do clients want to pay you in cryptocurrency? No problem! Thanks to Bankful, you can accept crypto transactions for your digital product and access your money in your local currency. It supports over 120 fiat currencies, including the US dollar.

If you prefer traditional payment processing, that’s fine, too. Bankful supports popular payment processors like Apple and Google Pay. It also integrates with popular e-commerce websites like WooCommerce and Shopify, allowing you to receive payments from multiple channels directly.

Pros

-

Syncs with QuickBooks for easy accounting automation. You can update transaction data in QuickBooks directly.

You can accept crypto payments and settle accounts in your preferred fiat currency

Integrates with top e-commerce platforms like Shopify and OpenCart

Flexible payments with Buy Now, Pay Later (BNPL)

Cons

-

It only supports limited payment methods

It’s limited to merchants in a few North American and European countries. If you’re a creator outside these regions, you might not be able to receive payments with Bankful.

Pricing

Bankful charges a monthly subscription fee plus fees for credit card volume and every transaction. Here’s the breakdown of the monthly subscription fee for each plan:

- Standard: Free

- Startup: $15

- Success: $20

- Bankful Plus: $95

You can check out the full breakdown of Bankful’s pricing and processing fees to see what each plan offers.

Payoneer: Ecommerce sellers and merchant payment solution

While Payoneer is popularly known as a payments app for freelancers, it’s much more than that. Payoneer users can also use this platform to receive payments for products listed on e-commerce marketplaces like Amazon and Shopify.

The global ecommerce marketplace feature offers a range of benefits, including competitive exchange rates, fast and secure transactions, and the ability to receive payments from multiple marketplaces and platforms in one place. With Payoneer, you can also track your payments in real-time and receive notifications when your funds are received.

Pros

-

Receive payments from multiple ecommerce marketplaces into a consolidated account

Receive payments in multiple currencies, including Canadian dollars and Yen

Track payments to know what’s pending and what you’ve received.

Track all your sales from Amazon with the Amazon Store Manager

Cons

-

It has a lengthy review process that can delay payment receipt

Its support team has a slow response time.

Pricing

You can open a Payoneer account for free, and there are no monthly subscription fees. However, the ecommerce marketplaces deduct fees for processing payments to your Payoneer account directly.

How to choose the best payment gateway for your digital product business

With so many payment gateways available, it can be hard to make the right choice for your business. Here are five things to consider as you vet the available options.

Compliance

Financial authorities regulate payment gateways to protect customer data. Most government authorities require payment gateways to comply with the Payment Card Industry Data Security Standard (PCI-DSS), which ensures that card transactions are secure and that cardholders’ data is less likely to be stolen.

If you collect health-related data while selling digital products, you may also have to choose a payment gateway that complies with the Health Insurance Portability and Accountability Act (HIPAA). If you’re accepting payments from European Union residents, you may also have to choose a payment gateway that is General Data Protection Regulation (GDPR) compliant.

Compliance is an essential factor in choosing a payment gateway – this aspect is a non-negotiable to keep your customer data safe.

Security

Data theft is a very real threat in the world of online payments—and that’s true for all businesses, from multi-billion dollar organizations to small startups.

To limit security risks, the payment gateway you choose needs to support data encryption. Some payment processors conceal card information to protect users’ data with a process called tokenization. It’s important to ensure that your payment gateway supports data encryption and tokenization for uncompromised security—to give you and your customers peace of mind.

Compatibility

The payment gateway you choose should also be compatible with various network processors. The major network processors include American Express, MasterCard, Visa, Diner’s Club, and Discover.

Network processors offer credit and debit cards that are co-branded with issuing banks. The more networks your payment gateway supports, the easier it is for customers to purchase your digital products. But at a minimum, you need to make sure your chosen payment gateway supports Visa and MasterCard.

Usability

There are many payment gateways that contain all the features you need, but not all of them can be integrated into the sites you’re using to sell digital products. Adding extra steps to your checkout process could cause customers to lose interest and abandon their carts. To deliver a seamless checkout experience with minimum friction, choose a gateway that easily integrates with your sales platform.

Universality

The beauty of selling digital products is that you can sell to anyone anywhere in the world. Don’t limit yourself to just serving customers in your current location. Although the US and the EU account for 85% of the market share of online courses, with translation tools like text-to-speech software, you can sell to a wider range of customers than ever before.

Choose a payment gateway that supports multiple currencies, complies with financial regulations across borders, and offers multilingual support to users.

Ready to find your ideal payment gateway?

PayPal and Stripe are ideal payment gateways for Creator Educators selling digital products online. They’re effective at helping you generate sales, keep customer data safe, and ensure you get paid on time without any hurdles. Compared to other payment gateways on the market, PayPal and Stripe are also the most widely accepted options for global users, and they support a wide range of currencies.

Thinkific integrates with both PayPal and Stripe, as well as having an optimized checkout process that’s designed to boost conversions for digital products. Thinkific makes it easy to set up both one-time payments and recurring revenue streams that run and run. All payments are directly transferred to your account, so you can set up your products, sit back and watch the money roll in.

Try Thinkific for free for 14 days and let us know what you think!

Payment gateways FAQs

Find answers to common questions about payment platforms for digital products.

What is a payment gateway?

A payment gateway is a type of front-end technology that lets you accept payments from customers. Payment gateways can include physical card-reading devices like the ones found in your local coffee shop, and online payment processing portals like PayPal and Stripe.

If you’re going to be selling digital products, you need to have a payment gateway to let you accept payments from your customers.

What is the best payment gateway for online creators?

Thinkific Payments is the best payment gateway for online creators, especially if you’re selling courses and memberships. It integrates with Thinkific’s powerful course builder and community platform, meaning you can create, host, and sell your digital product in one central place.

What should you consider when choosing a payment gateway for your digital product business?

Make sure that the payment gateway is secure and reliable. The last thing you want is to compromise your customers’ financial details and expose them to hackers and other bad actors.

Next, look for a platform that’s flexible enough to support transactions from multiple locations and currencies. Make sure its fees are reasonable so you don’t spend all your profit on transaction and processing fees.

This blog was originally published in August 2023, it’s since been updated in June 2024.