You’re focused on producing the highest-quality educational content out there. Right on! If you can spare a moment of your attention, we need to discuss something a little less exciting but equally crucial to the success of your online course business: sales tax.

United States sales tax rules are rapidly evolving, affecting all those selling digital products. Whether you’re based in Canada, the U.S., Europe, or beyond, it’s helpful to know how recent changes in U.S. sales tax law may affect your revenue when serving customers worldwide. This article provides an overview of the potential impact recent changes in U.S. tax law may have on your course business and provides simple steps on how to stay compliant.

Skip ahead:

-

What is sales tax?

How do sales taxes work in the U.S.?

Are online courses subject to sales tax?

What is sales tax?

Sales tax is the percentage of the total cost of an item or service that goes to the government whenever someone purchases that product.

Say an item costs $75 and the sales tax is 10%, $7.50 will be deducted from the total cost. Sellers collect sales taxes at the point of purchase and remit them to the government as they file their business tax returns.

How do sales taxes work in the U.S.?

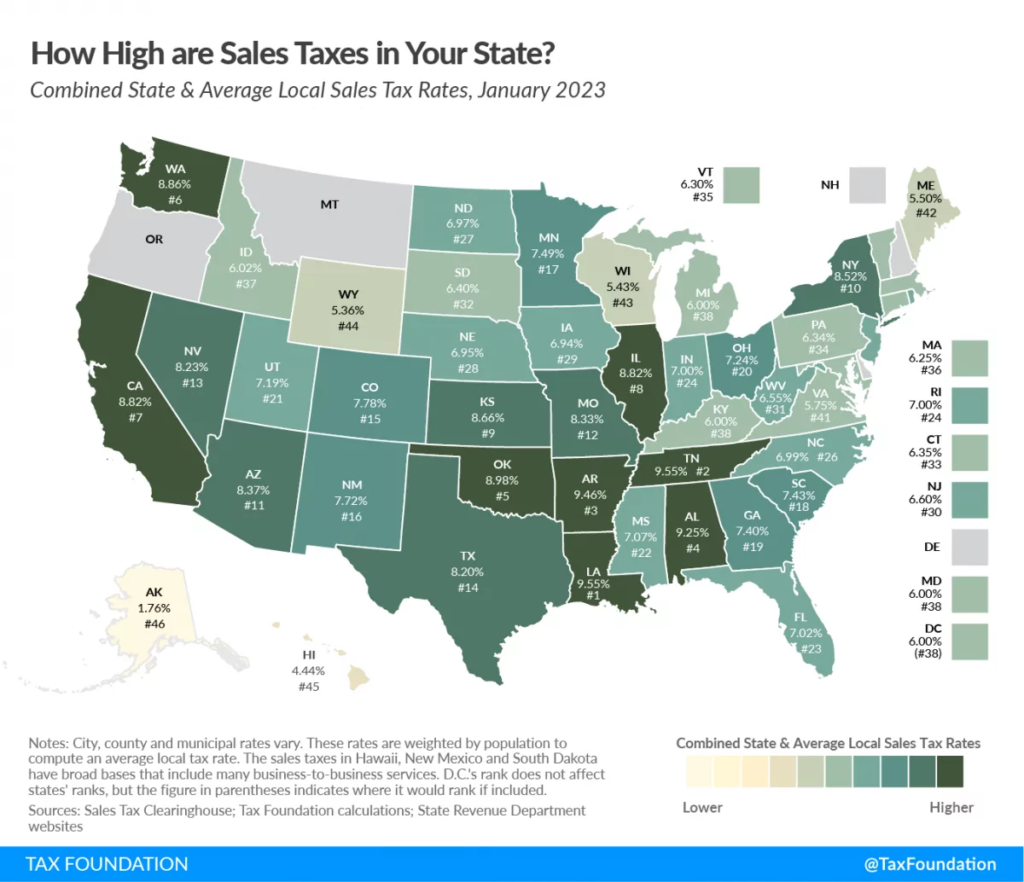

States impose their own sales taxes in the U.S., which means they determine the sales tax percentage and if you even need to pay at all.

Five states — Alaska, Delaware, Montana, New Hampshire, and Oregon — do not have statewide sales taxes, although specific sales in each state are subject to tax. For example, certain communities in Montana collect local taxes on items sold in resorts and hotels. And Alaska allows its local governments to charge local sales taxes on certain items.

Source: Tax Foundation

Are online courses subject to sales tax?

Despite being for educational purposes, online courses are not termed “educational products”. Rather, they are mostly classified as digital services or digital products because they are accessed through the internet. It also means online courses are subject to different types of digital taxes including sales taxes.

Generally speaking, an online course is taxable if it’s pre-recorded, automated, or includes downloadable materials. Of course, the 50 states and their respective tax policies contain specific rules and exceptions.

Thankfully, 24 states have adopted the Streamlined Sales and Use Tax Agreement which standardizes U.S. sales tax policy as much as possible. According to SSUTA guidelines, an online course is NOT subject to digital tax if it meets one of three requirements:

Downloadable vs. pre-recorded vs. live webinars

Live digital online educational services are not subject to sales tax. In other words, if you present your course or seminar live, then you are not expected to file sales taxes.

Learn more: How to promote your course with a webinar

Fully automated vs. interaction with and among students

If participants connect with each other or with you in real-time during the course, you are not liable to pay sales taxes.

According to SSUTA law, “The participants are connected to other participants and presenters via the Internet or other networks, allowing the participants to provide, receive, and discuss information together by live interaction, contemporaneous with the presentation.”

Related: Types of learning styles and how to teach them

Human-led evaluation vs. automated instructors

If an actual human evaluates the students during the course duration, then you would not owe sales taxes.

According to SSUTA provisions: “The participant is evaluated by an instructor. ‘Evaluated by an instructor’ does not include being graded by, scored by, or evaluated by a computer program or an interactive, automated method.”

Again, if it’s pre-recorded, if there’s no way for the students to interact with you or each other during the course, and if evaluations are automatic — then your course is subject to sales tax in the SSUTA states. Policies in the rest of the country are usually similar.

However, just because your course is taxable doesn’t mean your business actually has to charge any sales tax. That all depends on what’s called “nexus.”

Related: How to create a successful online course.

What is a sales tax nexus?

A sales tax nexus determines whether your business is liable to pay sales taxes to a particular state.

In the past, the physical presence of your business solely determined where you collected and remitted sales taxes. A physical presence nexus actually refers to anything — from you as a person to an employee, an office, or sometimes even a data server you’re using.

But in 2018, The U.S. Supreme Court ruled that a state can collect sales taxes from businesses outside its physical jurisdiction if such businesses generated a specific amount of money from transactions within the state in question — thus introducing the “economic nexus.”

The economic nexus means you’re liable to pay sales taxes to a state if your business activities exceed certain tax thresholds — regardless of your physical presence. Each state has a specific income or sales threshold, but the common thresholds are:

-

$100,000 in annual sales

Or 200 separate sales transactions in that state.

If you satisfy either of these, then your business has an economic nexus in the state and is liable for sales tax there. States like Connecticut and New York require you to meet both thresholds in order to collect and remit sales taxes.

Let’s say your business is physically located in Delaware, but you recorded 250 course purchases from California clients. In that case, you’re liable to collect and remit sales taxes on this digital product to the California state government.

Other types of sales tax nexuses that may apply to your business include:

Affiliate nexus

You have an “affiliate nexus” if you’re involved with a business or individual in the state, and you acquire students and sign-ups from this connection. Do you use a referral system for your online courses? Then your business could have this nexus in some places.

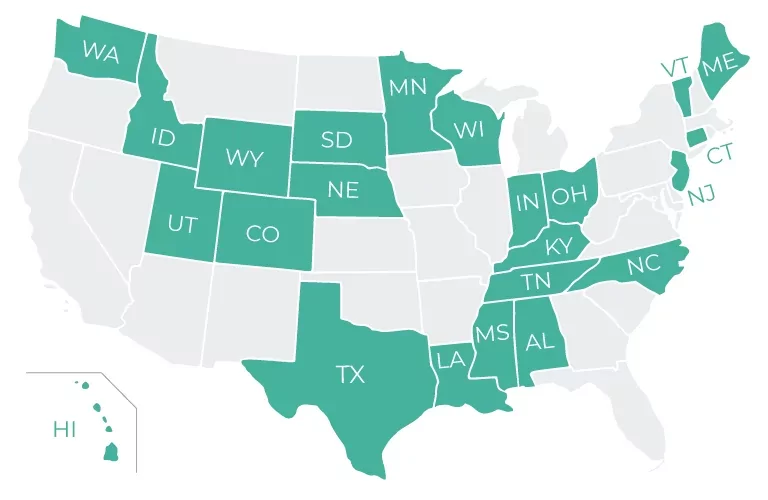

States that have some version of an affiliate nexus rule are Arkansas, California, Connecticut, Georgia, Illinois, Kansas, Maine, Missouri, Minnesota, New York, North Carolina, Pennsylvania, and Rhode Island. Many of these states have minimum sales thresholds, so the nexus only applies once you surpass a certain amount of gross sales in a year.

Learn more: How to sell your course with affiliate marketing

Click-through nexus

Similar to affiliate nexus, a click-through nexus exists when your business receives sales through the website of a business located in the state. If you run ads or links on an in-state website, which channels potential students and new sign-ups to you, this counts as the aptly-named “click-through nexus.”

States that have some form of click-through nexus on the books include Arkansas, California, Connecticut, Georgia, Illinois, Kansas, Louisiana, Maine, Michigan, Minnesota, Missouri, Nevada, New Jersey, New York, North Carolina, Pennsylvania, Rhode Island, Tennessee, Vermont, and Washington. Again, most states have a minimum sales threshold for this nexus, so the rule only kicks in once you surpass a certain amount of gross sales.

Web cookies

A few states consider software or web cookies on in-state devices as a business nexus: Massachusetts, Connecticut, Rhode Island, and Ohio. In all cases, the sales thresholds for this nexus are pretty high, meaning you have to gain a ton of online course sign-ups through these web cookies to qualify for sales tax.

Notice and Report laws

Similar to economic nexus policy, “notice and report” laws ensure that remote businesses still play a part in the state’s revenue collection, even if the businesses don’t have nexus and aren’t registered for sales tax.

Under these laws, remote businesses above a given threshold must notify certain customers that they need to pay sales tax to their state and then also report the list of these customers (and the amount of tax they owe) directly to that state revenue office.

This process can be a real hassle for business owners like you, so luckily, these laws only exist in three states: Oklahoma, Pennsylvania, and Rhode Island. If you’re ensnared by notice and report laws in any of these places, you always have the right to just register for a tax permit and handle sales tax the old-fashioned way.

How to determine if you have nexus in a particular state

To know if you’re liable to pay sales taxes to a particular state:

Assess where you have a physical presence

Take a look at your operations and figure out where you might qualify for the physical presence nexus.

Where you live and work certainly counts. Do you have a remote team who helps you produce or promote your online courses? Where are they located?

Assess your marketing practices

If you use affiliate or influencer marketing or online ads, figure out in which states these practices lead to sales. Carry out some degree of research to see if those states have an affiliate or click-through nexus laws and whether your business qualifies.

Check the number of sales you have generated from each state

If you have a ton of students in California, then you probably want to check in with California’s economic nexus laws. Did you hit the annual sales thresholds? If yes, get ready for sales tax. In general, though, if your total sales in a state don’t amount to the thousands, you’re probably off the hook.

How to collect and pay U.S. sales tax for your online course

Once you’ve determined where you have nexus, the next step is setting up your business to collect and remit due taxes legally.

Register for a valid U.S. sales tax permit

You need a U.S. sales tax permit to collect sales taxes on behalf of the government and remit them when they’re due. If you have nexus in multiple states, you’ll need to register for separate sales tax permits.

Thanks to digitization, you can register for your permit online via the state’s Department of Revenue, and you’ll receive your tax permit number within 10 business days. During the registration process, you’ll need to provide your personal and business information, social security number or employer identification number, and your business entity records.

Another option is to register for the 24 SSUTA states at once using a simple (and free) online application through the Streamlined Sales Tax Registration System (SSTRS). This method saves time but can result in unnecessary tax liabilities — like paying taxes to SSUTA states you have no nexus in.

Charge sales tax to your customers

This includes the overall state tax rate plus any county or district taxes that apply. Not every state has local-level taxes, though. Usually, the tax rate is based on where the customer is located, a destination-based tax. Only a few states have origin-based taxes, meaning you charge tax according to wherever your business is based.

Add the sales tax percentage to the sales price of your taxable products and collect the total amount from your customers.

Related: How do I charge taxes on Thinkific?

File sales tax returns in that state

When you register, each state will assign you a filing frequency. It could be once a month, once a quarter, or once a year. Be sure to note your deadlines and pay on time to avoid penalties. Again, check the individual states’ official websites and sales tax laws for specific information on how to file.

Thinkific’s integration with Quaderno helps you manage sales taxes for your online course

Quaderno automatically tracks your annual sales and tax thresholds and notifies you when you need to register for sales tax in a state. Quaderno then applies the correct tax rates, no matter where your customer is located, and sends automatic tax receipts, which you can also customize to fit your brand. Finally, all of your records will be stored securely for as long as you need them.

You can easily keep your business compliant and save yourself the headache of navigating the U.S. sales tax maze alone. Quaderno also integrates with PayPal, Stripe, Quickbooks, and Amazon, among many other tools you may need to run your business.

See how Quaderno can help you with a free 7-day trial as a Thinkific user.