One important part of being a business owner is learning how to properly track your finances. When you have a handle on your accounting, you stay organized and can make smarter, more impactful decisions for your business.

We know bookkeeping can feel overwhelming at first, but it doesn’t need to feel that way. Read on to learn about bookkeeping best practices from Thinkific Expert, Veronica Wasek, and the new bookkeeping tools available to you with TCommerce.

This blog post is brought to you by Veronica Wasek. Veronica is an expert in accounting and bookkeeping. She is a Certified Advanced QuickBooks ProAdvisor and also the creator of 5 Minute Bookkeeping.

Related: TCommerce: Less Time on Admin and Selling—More Time Teaching

What is bookkeeping and why should I care?

Let’s start at the beginning—bookkeeping is the process of recording your financial transactions, like income, expenses, and profits. It is an account record of all the money flowing in and out of your business.

There are 3 main reasons why you need to be on top of your books: to ensure your finances are accurate, to understand business health, and for complying with tax obligations.

Ensure your finances are accurate

The first step is making sure your financial reports are accurate—meaning there are no missing, duplicate or miscategorized transactions. This is important to ensure you are not losing money or overpaying tax.

The best way to ensure accuracy is by reconciling your sales on Thinkific with the “source of truth,” which is your business bank account and credit card statements, to make sure everything lines up. For example, if your course sales are $500 for the past 30 days but you only have $400 deposited into your bank account, there is a $100 discrepancy that you will need to investigate. Some common reasons for a discrepancy are student refunds or chargebacks. The purpose of looking into this discrepancy is to ensure that everything is recorded correctly and you aren’t missing any money.

TCommerce offers an easier way to reconcile your books!

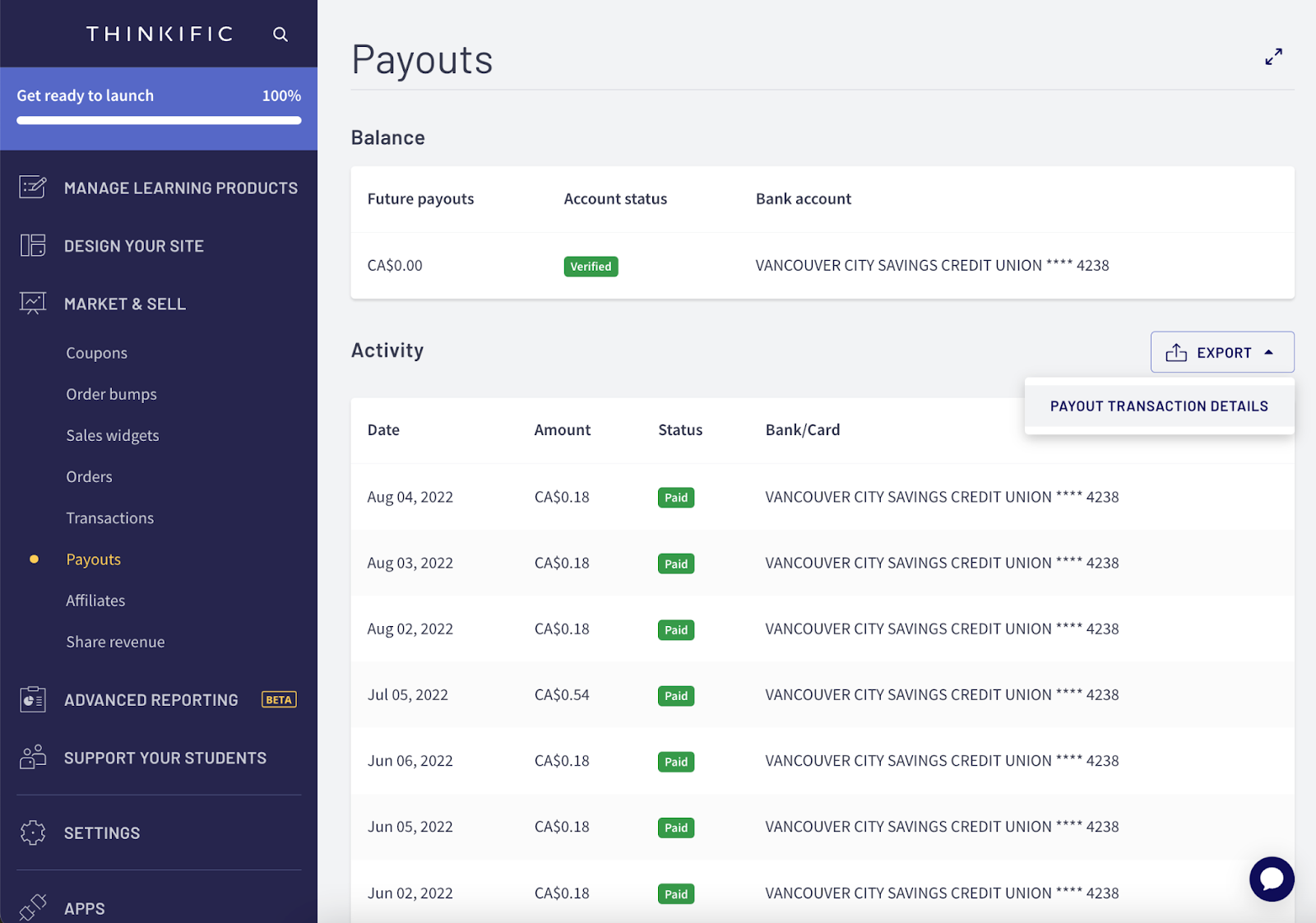

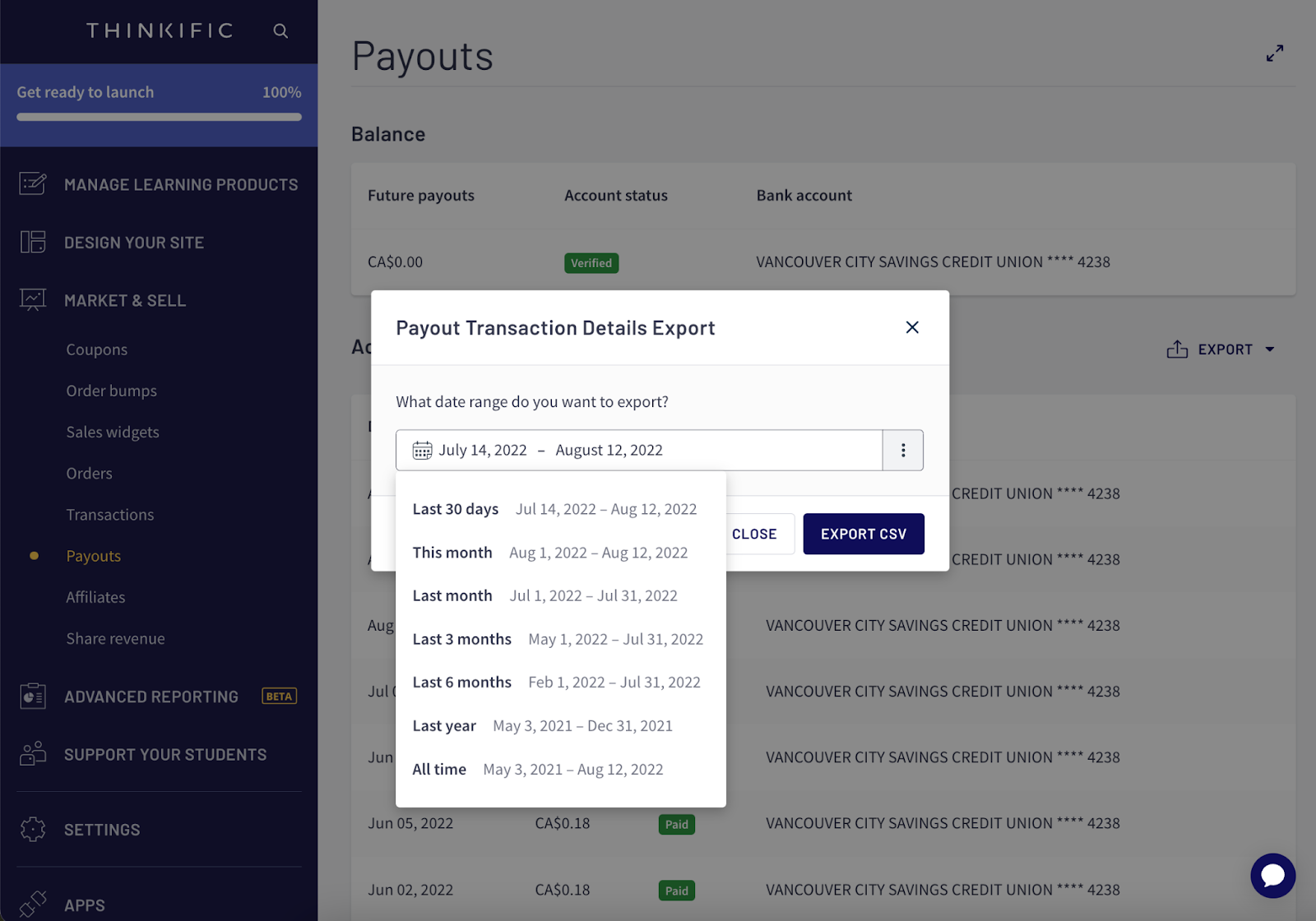

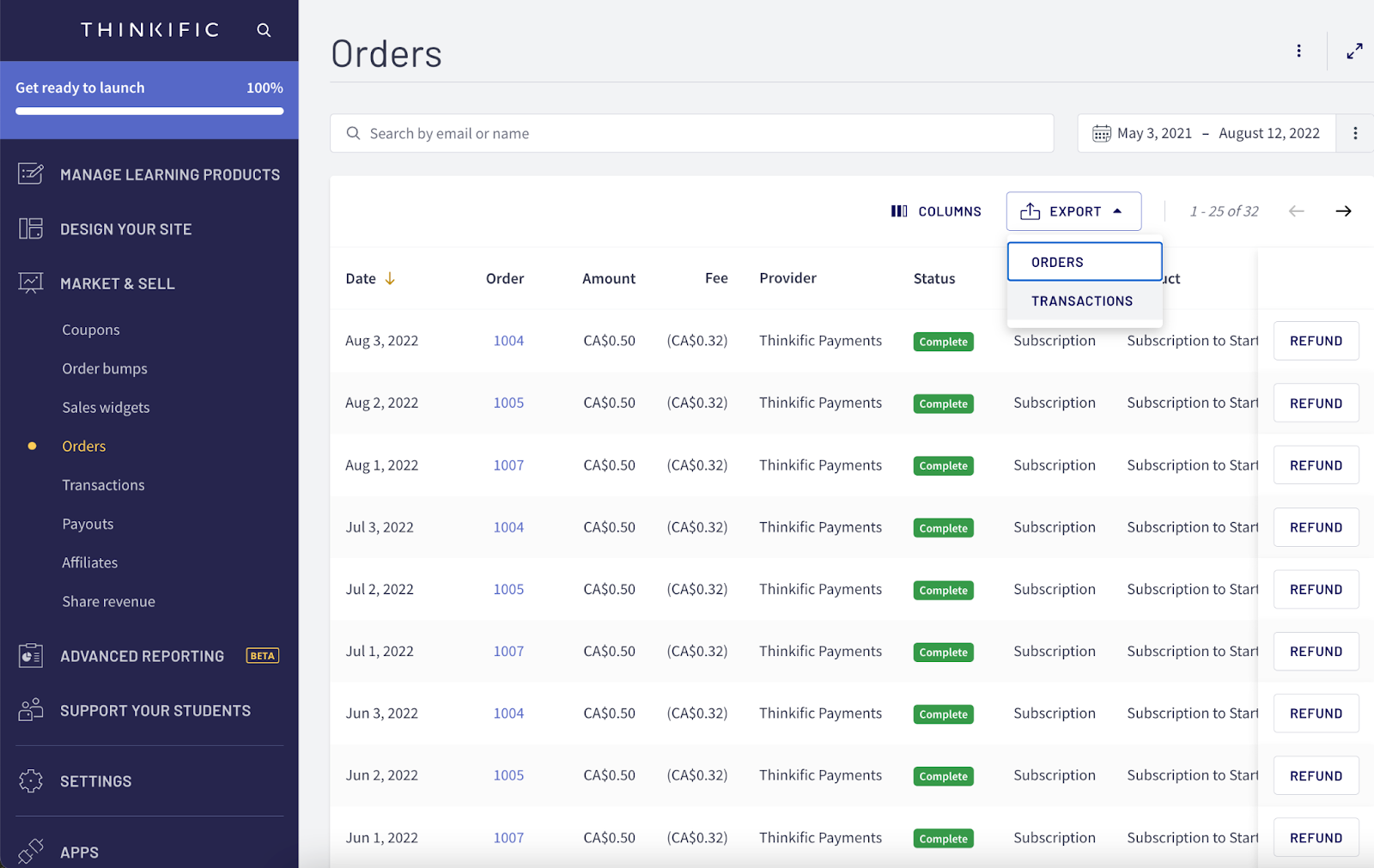

Navigate to your dashboard and download the Payouts Reports and Order Transactions Report in one click. The Order Transactions Report shows you all the individual student payments that were made within a date range. The Payout Report shows you the funds deposited into your bank account. Download the report to see which sales were paid out in which payout. You can compare these two reports when reconciling your books.

Another exciting feature coming soon is the Quickbooks Online integration with Thinkific. This is a way to automatically import Thinkific sales, fees, and refunds to Quickbooks.

Access your Payouts Report by heading to Market & Sell > Payouts in your admin dashboard. Select your date range and click “export csv.”

Read more: How one of the Top 10 Creators on Thinkific, Mina Irfan, Simplifies Her Business Using TCommerce

Access your Order Transactions Report by heading to Market & Sell > Orders in your admin dashboard.

Understand Business Health

You can use your financial reports to make sure your business is healthy and growing at a sustainable rate. These metrics help determine if you have sufficient funds to pay your expenses and that there’s enough cash flow in the bank should problems arise.

To understand business health you will want to constantly monitor 4 main metrics: expenses, profit, income taxes and cash flow.

- Expenses – the money you spend on your business (marketing, camera equipment)

- Profit – Profit equals income minus expenses. This is the money you take home.

- Income taxes – Money you pay on a yearly basis. You will need to set aside funds to cover income taxes

- Cash flow – Money in the bank to cover future expenses

Expenses and Profit are the main metrics you will monitor, as you need to make sure that your business is profitable or on the path to profitability. If you are constantly spending more than you make (beyond your initial startup costs) this is something to look into.

“A business may be profitable but can go bankrupt if there is not enough cash flow to cover upcoming expenses and income taxes. We need to monitor cash flow to make sure we can cover future expenses, pay ourselves and pay employees or contractors.”

– Veronica Wasek

Veronica explains that a healthy business is not just one that is profitable but also has a cash flow of funds set aside in case problems arise, and to pay income taxes. Therefore you need to monitor all 4 metrics to have a complete and accurate understanding of how your business is performing.

In addition to these core metrics, there are other Key Performance Indicators that you should monitor to help understand exactly what’s happening with your business. For example, if you’ve made fewer sales this month you will want to understand what happened—did you sell less Order Bumps? Is your Affiliate program underperforming? These are important questions to ask yourself on a weekly or monthly basis in order to identify problems and strategize on how to improve.

Some examples of KPIs to monitor are:

- Sales by course

- Coupon codes sold

- Order Bumps sold

- Affiliate sales, and more.

Complying with tax obligations

The last reason you need to spend time on bookkeeping is for compliance purposes. A financial report is necessary to prepare income tax reports and sales tax reports so you can complete tax fillings. While we won’t cover everything on tax today (that’s a whole separate topic!) it’s important that creators who make a certain amount of revenue charge taxes on their product sales.

Sales Tax is a tricky topic because it depends on where your business is based and where your students are located. If your business is based in Canada you will pay different income tax than someone based in the USA. If your student is based in California, they will pay a different tax than someone who lives in Texas. It can get confusing, which is why the majority of Creators who process enough sales will hire a third-party accountant. The most important take-away for creators is that when you start growing your sales you will need to record where your students are located and put aside enough time to accurately charge for taxes.

Sales tax with TCommerce – new features coming soon!

Thinkific is building exciting features that can help you with your tax obligations. You can now collect location data in the checkout and calculate your tax liability with the Transactions Report. This report will include enriched transaction data of purchases like student location so you can properly track your tax liability in any given jurisdiction. When this is available, you can go to the Transactions tab under Market & Sell in your Thinkific admin dashboard to access the report.

Proper bookkeeping etiquette and best practices

Now that you understand what bookkeeping is and why it’s important, let’s dive into some tips and best practices that you can begin exercising to make accounting a breeze.

Veronica’s 5 Step Monthly Bookkeeping process

Put aside at least an hour per month to dive into your books. This will ensure you are on the right track and do not miss any important tasks. Simplify follow these 5 steps:

- Record all financial transactions

- Reconcile transactions to business bank and credit card accounts

- Review how transactions were categorized

- Revise and make changes as needed

- Restrict and prevent changes to the books after they are completed

Consider using accounting software

Tracking your income and expenses is an integral part of bookkeeping. If you are processing a certain amount of sales you will want to consider using accounting software. Some common softwares tools area Zero, Wave Accounting or QuickBooks Online. We are currently working on integrating QuickBooks Online with Thinkific Payments. With this integration all your reports and payouts will automatically be imported into Quickbooks.

3 additional bookkeeping best practices to implement into your routine:

- Separate business bank & credit card accounts from personal accounts (i.e. create sub-accounts)

- Schedule time on your calendar to work on your books

- Simplify your bookkeeping process with TCommerce and Thinkific’s integrated payment processor

“I can’t tell you how simple our bookkeeping came when managing our own academy once we started using Thinkific Payments! We were using Stripe and we had installment payments which took a long time to manage on Stripe. It’s so easy to do it on Thinkific!”

– Veronica Wasek

Use TCommerce to make bookkeeping a breeze

Thinkific has built new tools to simplify bookkeeping—available when you set up TCommerce.

- Easily access your Payouts, Orders and Transactions reports

- Accurately charge for taxes by collecting student location data in the checkout

- Integrate with Quickbooks so your payout report is automatically bought into Quickbooks on a daily basis.

You can easily get onboarded to TCommerce by setting up Thinkific Payments, our payment processor built in-house. It only takes a few minutes to set up and is completely free.

Need more help with setting up? Read our Help Centre article.

TCommerce is currently available for businesses based in Canada, the US and UK. If you’re not located in these countries, check out this page and sign up to get exclusive access.

Related: TCommerce: Less Time on Admin and Selling—More Time Teaching

Read more: How one of the Top 10 Creators on Thinkific, Mina Irfan, Simplifies Her Business Using TCommerce