When COVID-19 prompted lockdown measures across Europe and North America in March 2020, the impact on brick and mortar establishments was immediate. From sprawling factories to mom-and-pop corner shops, the pandemic drove customers and employees back into their homes and forced business owners to reconsider their future.

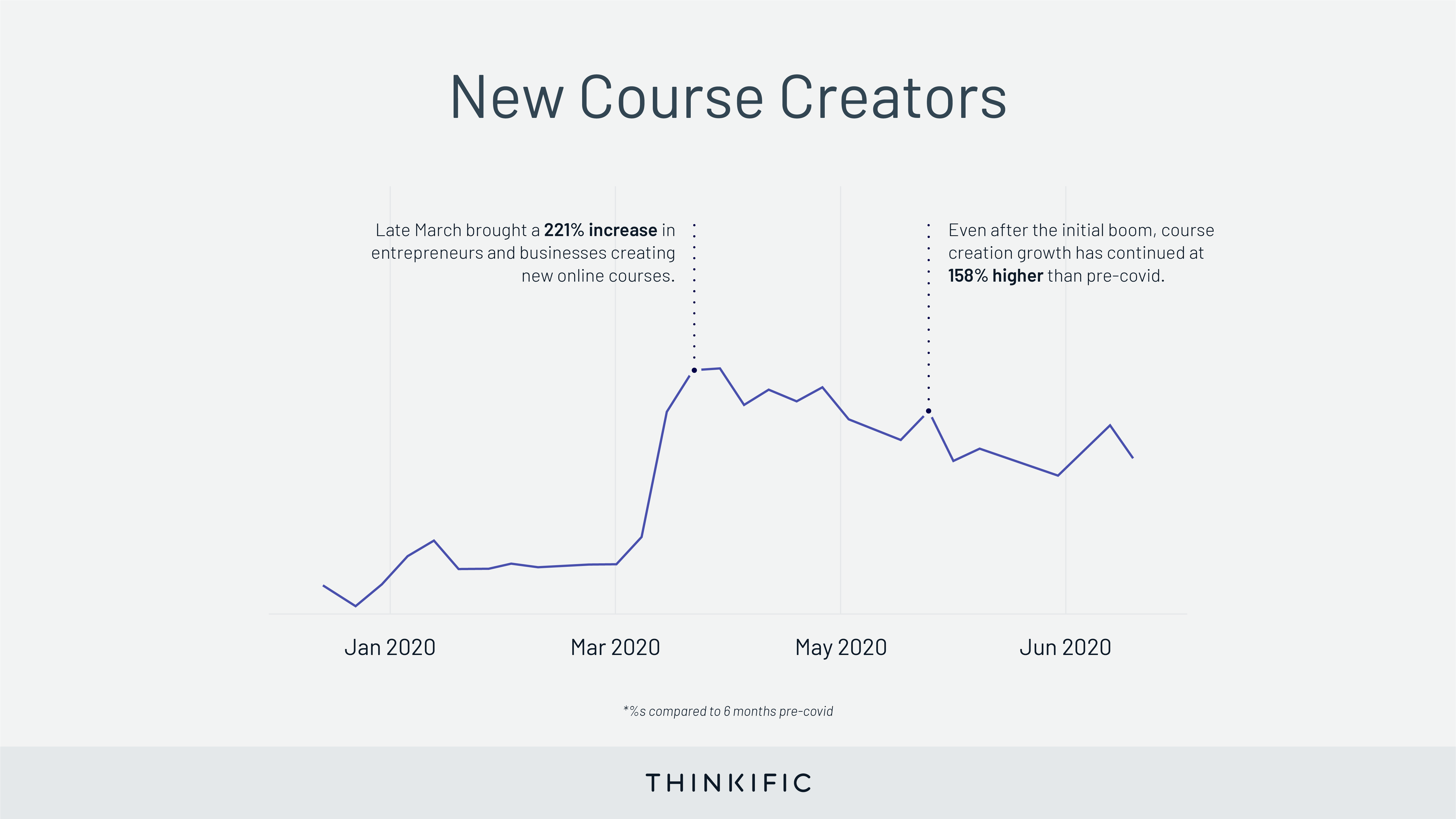

Many of these businesses turned to online education as a way to keep their business afloat. In early 2019, the online course industry was forecast to be worth $300B by 2025. The pandemic has rapidly accelerated this timeline, as entrepreneurs, businesses, and teachers pivot online – resulting in a 221% surge in new course creation in the early days of the pandemic.

Based on this early boom, we asked a few key questions:

- How will this growth play out in the long term?

- What skills are people learning online, given the shift towards a remote workforce?

- What does this mean for current and future online course creators?

In the trend report that follows, we dig into these questions and more.

Understanding the data

This report covers key insights in the online course industry, based on the first-touch reactions to COVID-19 as well as the slow-burn trends that followed.

To gain these insights, we looked at two distinct time periods. Data from March 15-31 showed the immediate impact of pandemic-related lockdown measures, while data from April 1-June 30 revealed a snapshot of continued trends as the world began settling into a new normal. To measure the growth of these periods, we compared both to average benchmarks within a 6-month period prior to March 15.

Across these three timeframes, we’ve measured new course creators, new student enrollment, and new courses. Note that throughout this report when we reference course creation growth, that figure represents only courses with 10 or more student enrollments to ensure numbers aren’t inflated by empty courses.

While this data was collected from Thinkific’s business model specifically, and therefore may differ from other online course providers based on a range of demographic factors, it offers a snapshot into the trends of the online course industry based on one of the world’s leading online education platforms.

The Early Boom

The pivot to online courses

In the early weeks of COVID-19 lockdown measures, we saw a 221% increase in new course creators on our platform. These figures represent a range of creator types with a variety of goals, including but not limited to:

- Entrepreneurs and businesses with established brick-and-mortar businesses who pivoted their products and services online when COVID-19 forced them to close their doors.

- Educational institutions from K-12 to post-grad who took their learning material online to support distance learning and tutoring services.

- Career changers and solopreneurs who took an existing skill or talent and leveraged it into a new online course business to support their income when faced with lay-offs and career changes brought on by economic uncertainty.

- Businesses and human resource professionals who created online training courses to help them onboard new employees remotely.

Considering many creators built more than one course, we tracked a 368% increase in new courses created on the platform in those final two weeks of March.

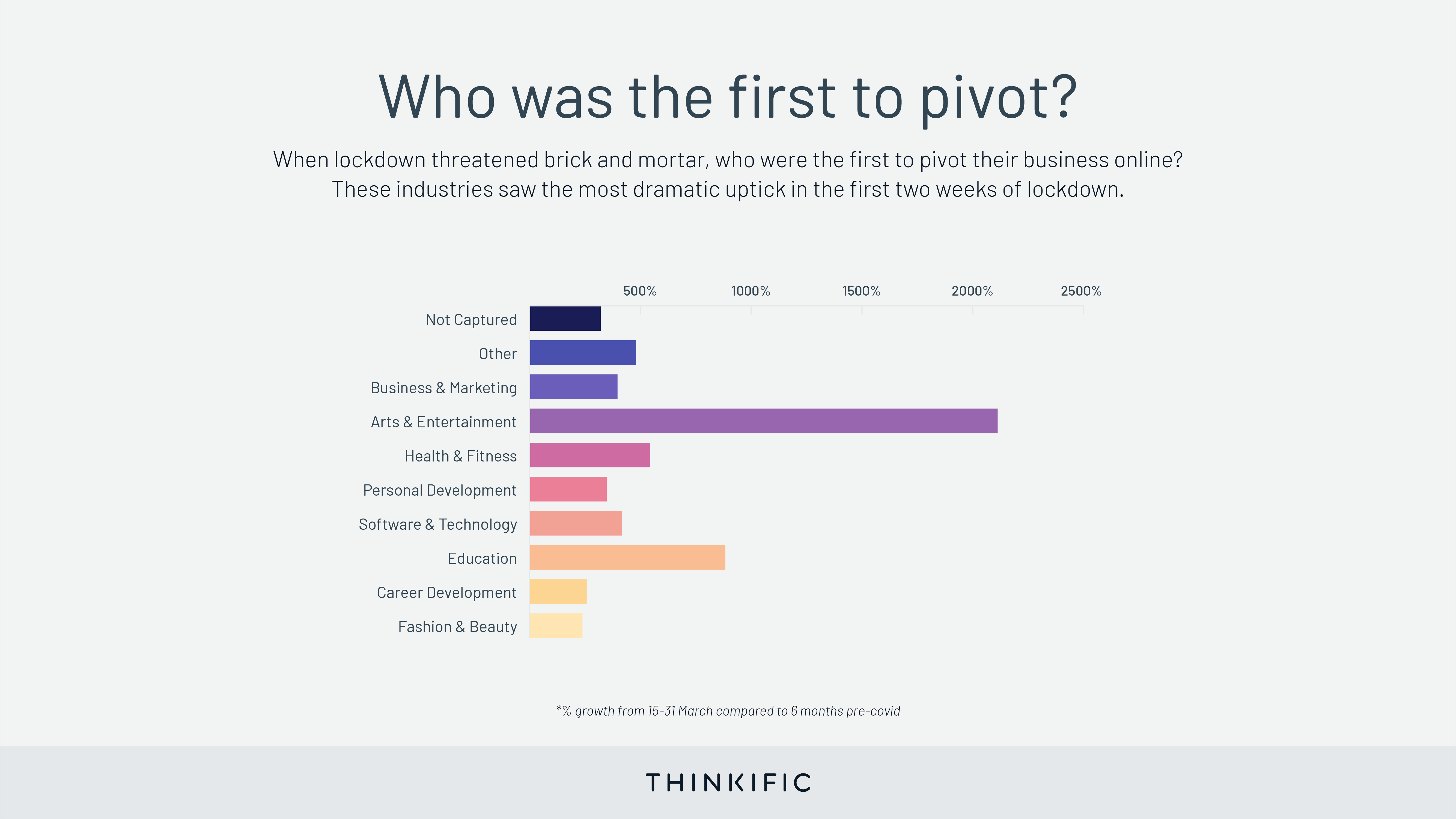

While we measured growth across every category, three industries stood out as first adopters:

- Arts & Entertainment courses exploded by a mammoth 2108% with a range of talented entrepreneurs offering everything from marketing, photography, and graphic design to weaving, painting, and hip-hop dance.

- Education came next with a growth of 881% and courses teaching everything from macroeconomics to AP history.

- Health & Fitness courses grew by 543% as yoga instructors, pilates studios, and other health professionals moved their practices online.

We also tracked a combined 798% growth in courses where creators identified as Other or where their industry was Not Captured.

Online course growth across the world

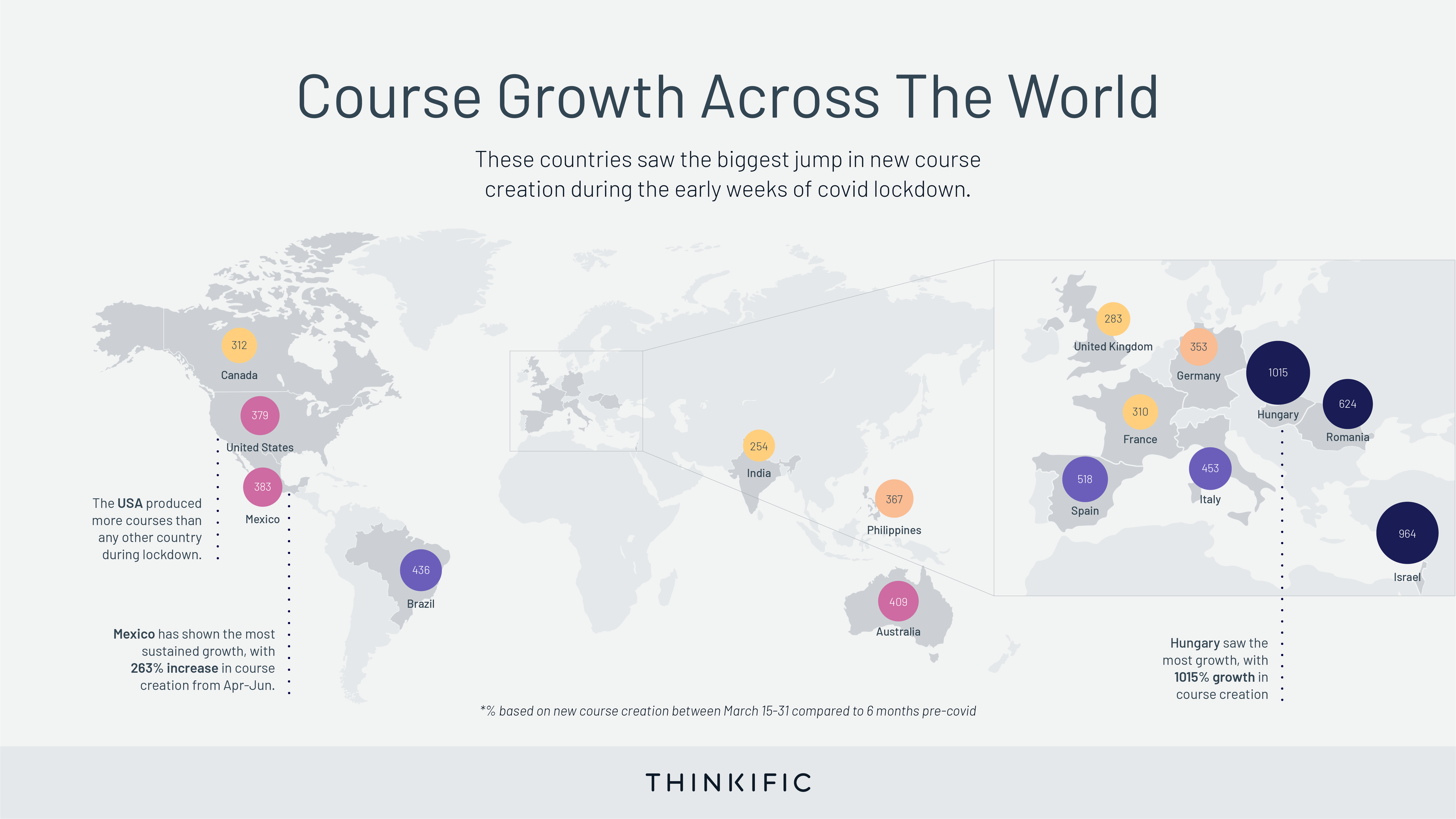

While a high proportion of pre-pandemic course creation was concentrated in North America, the online course industry growth that followed was global.

- The United States and Canada saw a combined growth rate of 691% compared to course creation in the 6 months preceding COVID-19.

- Hungary saw the sharpest growth rate, starting with only a handful of courses in the 6-month pre-pandemic period and ballooning with a 1015% growth in new courses in the second half of March alone.

- Mexico saw an initial growth of 383% in late March, but they’ve had the most sustained change throughout April-June as their growth has continued at 263% above pre-pandemic averages.

- Following Mexico’s trend of sustained growth, India and Spain trail close behind with 230% and 215% growth respectively.

While many countries saw a dramatic spike in course creation in late March and a steady levelling off in the months that followed, each of these top 15 countries settled into a significantly higher course creation rate – ranging from 115% to 263% higher than pre-pandemic averages. This demonstrates that around the globe, online courses continue to be a powerful tool as the world settles into a new normal.

Student engagement with online courses

It’s one thing for entrepreneurs and businesses to move online, but student engagement is another question altogether. With the pandemic driving everyone indoors, what were potential students doing with their time?

In the second half of March, student enrollment grew by 217%. While Russia, the United Kingdom, and the United States saw massive growth exceeding 200% of their pre-pandemic rates, the highest concentration of new students came from the United Arab Emirates as the Mohammed Bin Rashid University of Medicine and Health Sciences (MBRU) launched their interactive MBRU Community Immunity Ambassador Program online, attracting hundreds of thousands of students and catapulting their growth rate by more than 53,000%.

Certain industries stood out as clear favorites with huge jumps in student enrollment:

| Arts & Entertainment | 936% |

| Fashion & Beauty | 691% |

| Health & Fitness | 516% |

| Education | 343% |

| Career Development | 340% |

| Business & Marketing | 279% |

| Other | 243% |

| Software & Technology | 234% |

| Personal Development | 155% |

| Not Captured | 139% |

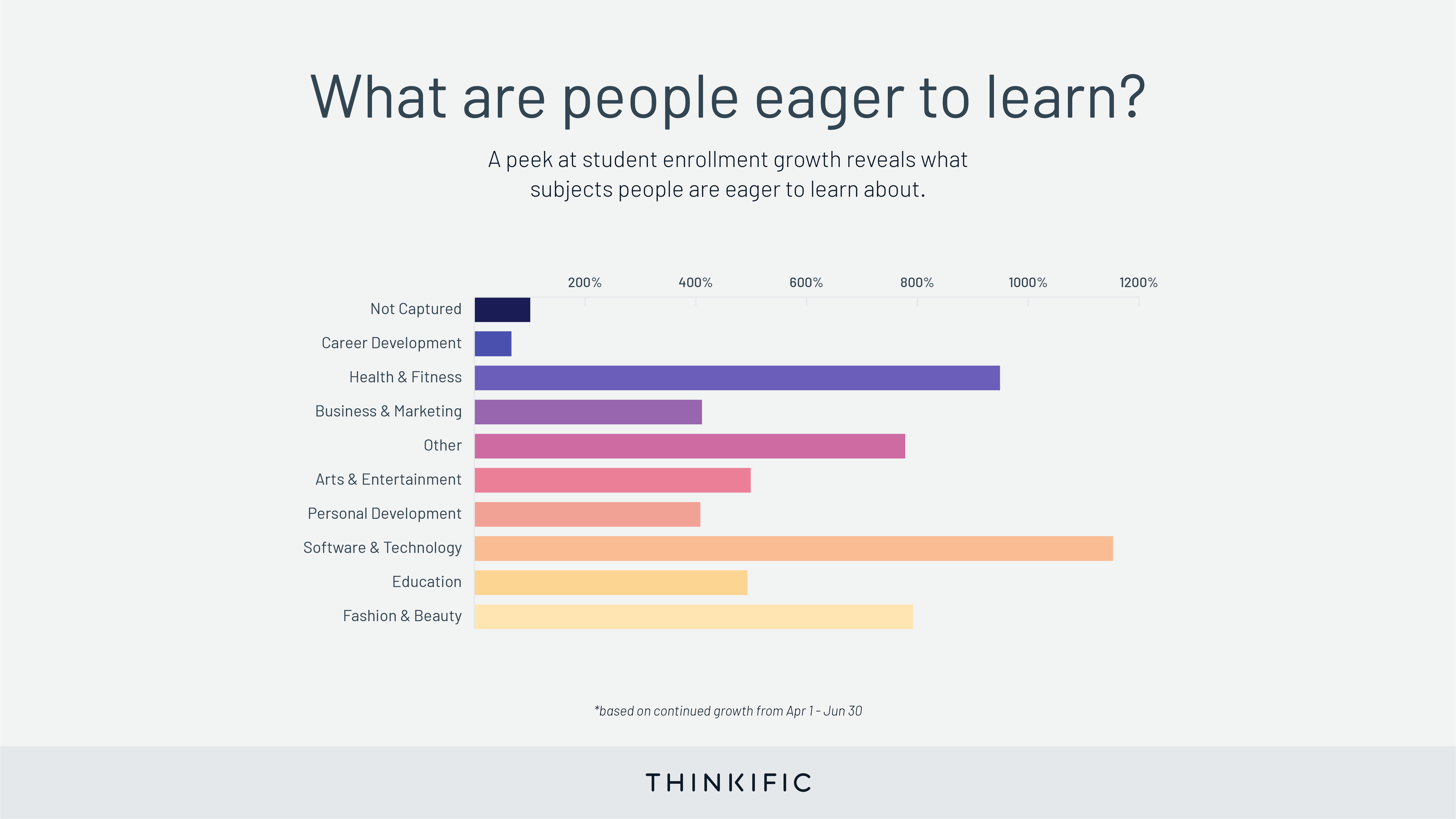

Software & Technology earns an honorable mention here; while enrollments grew 234% in the early weeks of lockdown, it skyrocketed by more than 1150% in the months that followed. This may come as little surprise, with many looking to expand their skills in the remote workforce where technology-driven roles abound.

The Slow Burn

So far we’ve touched on a handful of examples where metrics have stood out for their growth in April-June as much as for their initial figures in late March, but let’s dig in further to see what trends emerged in the months immediately following global lockdown measures.

Evolving student demand

From April-June, student enrollment growth remained relatively steady at 200% above pre-covid figures, showing that the increased student demand for online courses was here to stay.

Most industries showed continued growth in student enrollment:

| Software & Technology | 1153% |

| Health & Fitness | 949% |

| Fashion & Beauty | 792% |

| Other | 778% |

| Arts & Entertainment | 499% |

| Education | 493% |

| Business & Marketing | 411% |

| Personal Development | 408% |

| Not Captured | 101% |

| Career Development | 66% |

All but three of these industries saw significantly more growth in this period than they did in the initial post-lockdown growth phase. This speaks volumes about the trend of student demand towards courses that align with a post-pandemic landscape. For example, Software & Technology and Education offer key opportunities to meet the needs of distance learning and an increasingly remote workforce, while students who are looking for home fitness options are increasingly turning to online Health & Fitness courses.

Continued online course growth

Where student demand has increased over time, course creators have risen to the challenge as new course growth has continued across each category at considerably higher rates than before the pandemic. Consider for example that Business & Marketing has the lowest growth rate of all defined categories at 261% of its pre-covid rates, while Education and Arts & Entertainment lead the charge with growth rates of 732% and 722% respectively.

Despite these figures, student enrollment figures across every country and industry still outpace that of new course creators, spelling continued opportunity for current and aspiring course creators eager to fill the gap.

The Long Game

These figures paint a picture of a thriving online course industry, where entrepreneurs are finding new opportunities to market their skills despite the economic challenges brought on by COVID-19. This explosion of online course creation isn’t a lockdown-driven one hit wonder; it’s a trend that continues to pick up steam as entrepreneurs, businesses, and educational institutions turn online courses into their solution for an uncertain future.

As the world collectively stares down a landscape of revolving distancing measures, economic shifts, and an increasingly distributed workforce, some see opportunities for innovation. Whether it’s the chance to leverage your talents into your income, make the move into a new career, change the way we think about education, or streamline the way businesses onboard employees and interact with clients, the pandemic has paved the way for the world to step outside routine and explore new and better opportunities – and online courses are the vehicle for success.